How Call Options Work

A trader can either buy or sell call options, buyers are looking for appreciation and sellers want near term profits.

Call options are a type of financial derivative that gives the holder the right, but not the obligation, to buy a specific quantity of an underlying asset at a predetermined price (called the strike price) within a specified time period.

- Introduction

- Call Option Basics

- Two Parties of Option Contracts

- Call Option Strategy

- Call Option Purchase Example

- Option Leverage

- Conclusion

- Outro

Introduction

To profit from call options strategies, you must thoroughly understand call options and how to use them. For a basic understanding of how basic calls and puts work, click here.

Call Option Basics

In this article, we are going to explore call options in depth. As a review, be sure you understand the following concepts:

- Underlying Asset: The asset on which the call option is based. This can be stocks, commodities, indexes, etc. The price of the underlying will determine part of the option's value. An option will have value or be worthless at expiration based on the underlying asset price.

- Strike Price: The price at which the option holder can buy the underlying asset. The distance from the strike price determines the intrinsic value of the option. When the price of an underlying is above the strike the intrinsict value will be positive, when below the intrinsic value will be negative.

- Expiration Date: The date on which the option expires. After this date, the option is void.

- Premium: The price the buyer pays to the seller for the option. This is usually paid upfront.

- In the Money (ITM): A situation where the underlying asset's current price is higher than the strike price.

- Out of the Money (OTM): When the underlying asset's price is lower than the strike price.

- At the Money (ATM): When the underlying asset's price equals the strike price.

Two Parties of Option Contracts

A trader can buy or sell call options. Buyers want appreciation, and sellers want near-term profits.

- Call Option Seller: Also known as the "writer," a call option seller promises to sell an underlying asset at a specified price on or before the expiration date. In exchange, the seller receives a premium at the time of the sale.

- Call Option Buyer: Also known as the "holder," this person speculates that the price of an underlying will increase or, in some instances, stay the same by expiration. In exchange, the buyer pays a premium to the writer.

Call Option Strategy

- Buying a call option is generally a bullish or neutral strategy

- Selling a call option is a bearish to a neutral strategy

For example, traders can be "short-term bearish" and "long-term bullish" on a particular asset (or stock or ETF). In this case, a trader can buy a stock (bullish), sell a short-term call (bearish), and collect income from the call premium. This would be an example of a "covered call" strategy.

Call Option Purchase Example

A call buyer (holder) believes that XOM (Exxon Corp.) will increase soon because of economic turmoil in the Middle East. This buyer can buy the stock at around $114.50 per share (totaling $11,450.00 for 100 shares) or can purchase a 115-strike call option that expires on Oct 18th, 2024, for $615.04 for a hundred-share call option contract.

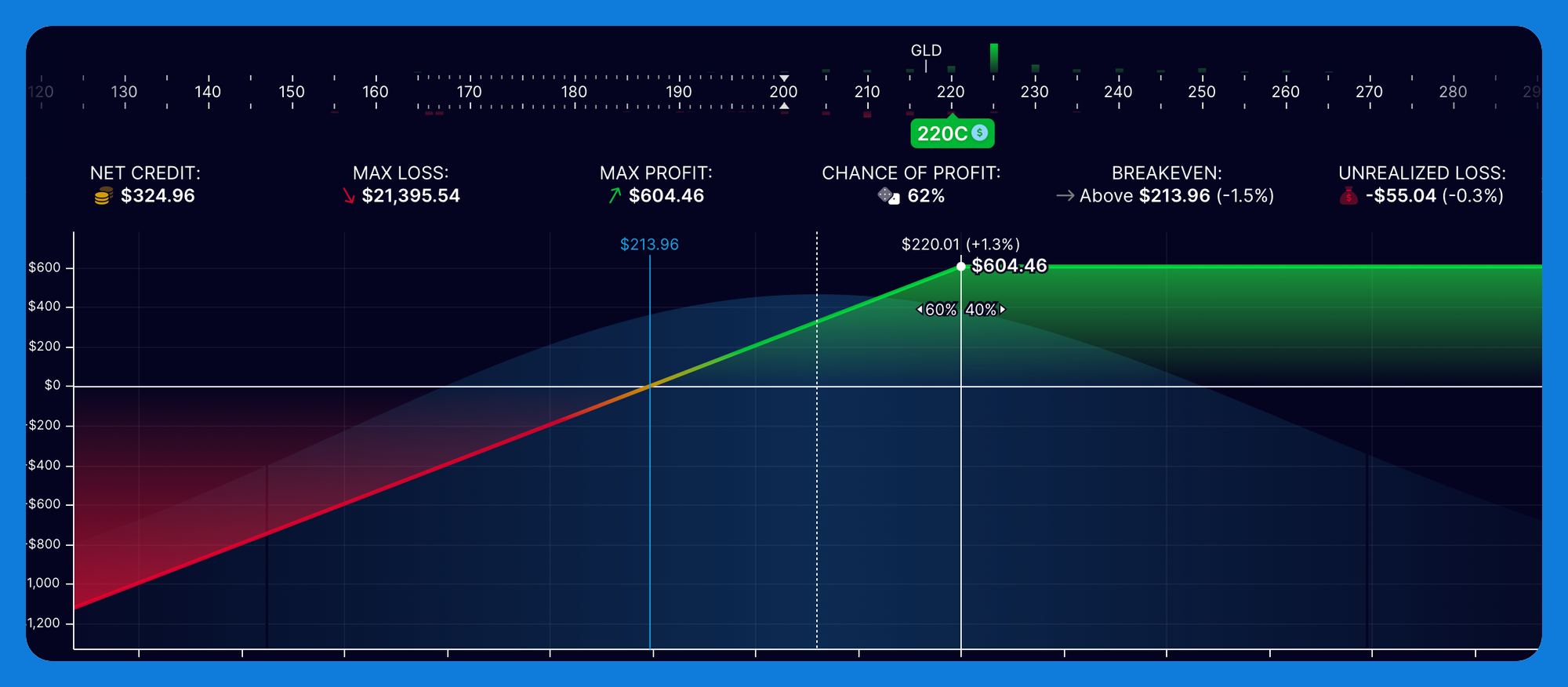

The picture above provides a few insights into this trade. Because the call option buyer is paying for the option, their downside (risk) is limited to the price they pay for the option.

We also see that the "break-even" price for XOM and this call option is $121.15. Above 121.15, the buyer is profitable. Below the break-even, the trade is not profitable.

The upside potential of a call option buyer is theoretically unlimited, but in practical terms, it will be limited by the highest potential price a stock can reasonably attain before the expiration.

In this example, if the price of XOM goes to $125 by the expiration, then the holder would stand to make a tidy profit.

125 (future price) x 100 (number of shares in a contract) = $12,500 gross

115 (strike price) x 100 = 11,500 (stock cost) + 615.04 (premium cost) = 12,115.04 total cost

Profit = 12500 - 12115.04 = 384.96

This 384.96 represents a 62.5% return on the initial investment.

If the buyer had purchased the stock at 114.50, it would have cost $11,450 and profited $1050.00. Though the nominal return would be more significant, the percentage ROI would only be 9.17%.

The question becomes, why was the option return so lucrative? That answer is leverage.

Option Leverage

Leverage allows the option investor to control many shares with a smaller initial capital outlay. In the case of stock options, each contract represents 100 shares of the underlying stock.

Leverage can allow an investor to increase returns, but it can also introduce more risk to the transaction. This increased risk can leave an option buyer with a total loss of all premiums paid.

It is said that legendary investor Charlie Munger once quipped:

There are only three ways a smart person can go broke; liquor, love or leverage.

Leverage can be a powerful tool, but a complete understanding of the risk is integral to any option vendor's tool kit.

Conclusion

Call options are versatile financial instruments that can be used for speculative purposes or hedging strategies. Understanding call options' mechanics, risks, and techniques can empower investors to make informed decisions and effectively manage their portfolios.

Whether buying to capitalize on anticipated market movements or selling to generate income, call options offer a range of possibilities tailored to various investment goals and risk appetites.

Outro

Be sure to subscribe to this site; we will take a fundamental approach to building an options vending business, learning the profession, discovering what to avoid, and sharing what I wish I had started sooner.