How Put Options Work

A trader can either buy or sell put options. Buyers are looking for protection or speculation, and sellers want near-term profits.

Put options are a type of financial derivative that allows the holder the right to force the counterparty to buy a stock or ETF. It is important to understand that for all options contracts, the holder (buyer) of an option is never required to do anything. Conversely, the writer (seller) of an option can be forced to buy or sell securities. In the case of put options, the seller of the option can be forced to buy at a specified price (the strike price).

Put options can be more difficult for beginning options traders to understand. Put options are often compared to "price insurance." If you own a put and the price of a security drops below the strike price, you can force the option seller to buy the security from you at the strike price. In this way put options provide downside protection to the buyer of an option that owns the security. Having a complete understanding of put options and how to use them is required to profit from strategies using put options. For a basic understanding of how basic calls and puts work, click here.

Put Option Purchase Example

A Put buyer (holder) believes that AAPL (Apple Corp.) will decrease soon because of sluggish iPhone sales. This buyer owns 100 shares of AAPL that she purchased a long time ago and has significant gains. She isn't sure the price will drop, but she doesn't want to risk a significant price decrease.

Currently, AAPL is trading at around $197 per share. She doesn't want to sell outright because of taxes, but she would rather pay taxes if the price dropped significantly than take a huge loss. She buys a put option for $190 that expires on Oct. 18, 2024.

This put option will cost her $540.00 ( $5.40 x 100, options contracts are sold in 100 lots). She is paying this money because she wants the protection. The put seller will keep this premium and buy 100 shares of the stock if the price drops below the strike price of 190. If the price stays above 190 the option will expire worthless. The option seller keeps the premium no matter what.

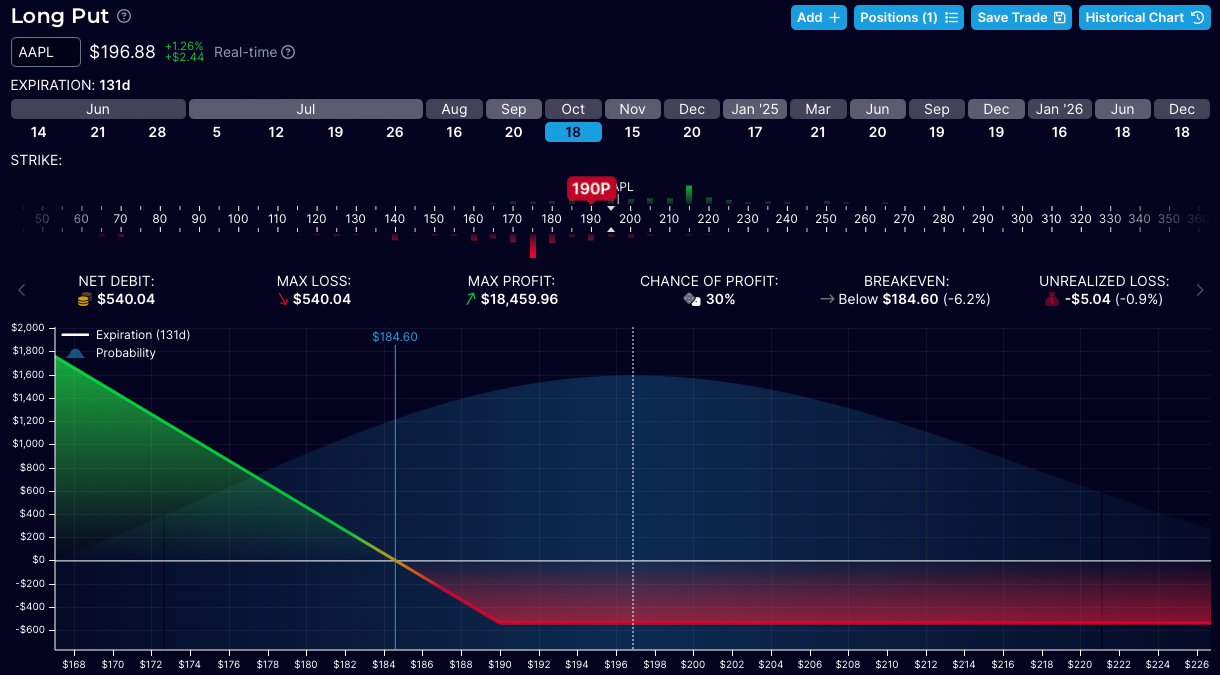

Above, we see a screenshot of the OptionStrat.com option pricing analyzer. From this picture, we learn a few things:

- The cost of the option is $540.04 (5.40 x100)

- The max loss is the price paid for the put option (the debit)

- The break-even price is 184.60; this is the price of AAPL, at which, if the price drops below, the transaction becomes profitable.

- If the Price stays above the strike price by expiration, the option buyer will lose 100% of the premium paid (debit).

- If the buyer doesn't exercise their "option," then the option seller (writer) will keep the premium and not have to buy the shares of AAPL

In this example, only time will tell if this transaction is profitable for the buyer or the seller. However, as we explore deeper, we don't need to know the outcome of the trade to understand how put options work.

In this post, we will go into greater detail about put options. As a review, be sure you understand the following concepts. Notice that many of these are opposite for puts than what we saw in the Calls Explained post:

- Underlying Asset: The asset on which the option is based. This can be stocks, commodities, indexes, etc. The price of the underlying will determine part of the value of the option. Ultimately, at expiration, the price of the underlying with respect to the strike price will determine value.

- Strike Price: The price at which the option holder can sell the underlying asset. The distance from the strike price determines the intrinsic value of the option. When the price of an underlying is below the strike, the intrinsic value will be positive for put options, and when it is above the strike price, it will be negative.

- Expiration Date: The date on which the option expires. After this date, the option is void.

- Premium: The price the buyer pays to the seller for the option. This is paid upfront. The seller (writer) of the option keeps the premium no matter the transaction's outcome.

- In the Money (ITM): A situation where the underlying asset's current price is below the strike price. All put options will be ITM when the security price is below the strike price.

- Out of the Money (OTM): When the underlying asset's price is HIGHER than the strike price. All put options will be OTM when the underlying price is above the strike price.

- At the Money (ATM): When the underlying asset's price equals the strike price.

Options Contracts Have Two Parties

A trader can either buy or sell put options. Buyers are looking for protection or speculation, and sellers want near-term profits.

- Put Option Sellers, also known as the "writers," promise to buy an underlying asset at a specified price on or before the expiration date. In exchange, the seller receives a premium at the time of the sale.

- Put Option Buyer: Also known as the "holder" is speculating that the price of an underlying will decrease or is betting on price action by expiration. In exchange, the buyer pays a premium to the writer.

Put Option Strategy

- Buying a put option is generally a bearish or neutral strategy

- Selling a put option is a bullish to neutral-strategy

For example, a trader can sell a short-term put, hoping to move into a position at a great price and collect income from the put premium. This would be an example of a "cash-secured put" strategy.

Puts for Protection

From the examples above, it is clear why traders would want to buy put options for protection. Owning a stock can be risky, and buying a put on a stock you own can reduce the black swan risk of owning the asset.

As a stock owner, especially if I own a large portion of my portfolio in one security, it may make sense to buy some puts so a dramatic drop in evaluation doesn't destroy my net worth.

Many pension funds are required to buy puts for protection, which can drive the price of puts up significantly. This, combined with the market's trend to increase over time, makes it an interesting and valuable tool to understand.

Puts for Income

As we said before, there are always two sides to a transaction. It is clear why someone would buy puts for protection, but why would there be a market to sell puts?

Selling puts in an increasing market can be a straightforward way to earn income. As a side benefit, selling a put allows a trader to buy a stock at a price below the market if the opportunity arises and profit if the price stays higher.

Recently, we investigated a way to participate in the upside of a stock that seems too expensive to buy outright. Click the link to see how to profit from selling puts in Nvidia.

Outro

Be sure to subscribe to this site; we are going to take a totally fundamental approach to build an options vending business, learn the profession, discover what to avoid, and what I wish I had started sooner.