Strike Price In Options

In the option trading discipline "strike price" refers to the value of an underlying security that the asset can be bought or sold.

Simply speaking options have 4 basic qualities; strike price, underlying, expiration and type (call or put). Strike price selection is critical to being consistently profitable.

In the option trading discipline "strike price" refers to the value of an underlying security that the asset can be bought or sold. Strike price of a call option is the price that a call option holder can buy an asset. Conversely the strike price of a put option is the price at which a security can be sold, by the option holder.

- Call options: Give the holder the right to BUY an underlying at a predetermined strike price

- Put options: Give the holder the right to SELL an underlying at a predetermined strike price

The Strike price is set when an option is created and is fixed for the term of the contract (except in the case of a stock split where the contract will be adjusted to account for the new capitalization.) In case these terms are unfamiliar please refer to our

options basics article.

Moneyness (Funny Word, Important Concept)

The strike price will be the single factor that determines if an option is:

- In-the-money (ITM): A call option is ITM when the current price of the underlying is ABOVE the strike price. A put option is ITM when the current price of the underlying is BELOW the strike price.

- At-the-money (ATM): For both put and call options, they are said to be ATM, when the underlying price is at the strike price.

- Out-of-the-money (OTM): A call option is OTM when the current price of an underlying is BELOW the strike price. A put option is OTM when the underlying asset is ABOVE the strike price.

Relationship of Strike and Option Value

When an option is ITM it has intrinsic value. An option that is OTM has no intrinsic value. Intrinsic value is the dollar (or other currency) amount that the call option is above (or below for puts) the strike price.

- Ex. 1 - A call option for XYZ corp. has a strike price of $95.00 the current price of the stock is $100.00. Therefore the option has an intrinsic value of $5.00.

- It is important to note that options contracts for stocks are sold in lots of 100 so if an option is $5.00 ITM then the option contract would be worth $500.00 at expiration.

- Ex. 2 - A put option for ABC corp. has a strike price of $80.00 the current price of the stock is $70.00. This put option is $10.00 ITM (80[Strike Price]-70[Stock Price]=10[Intrinsic Value])

- As previously noted an option intrinsic value is multiplied by 100 to determine worth at expiration.

Option price is made up of more than just the intrinsic value. OTM options have value as well, this value is known as "extrinsic value." Extrinsic value is more difficult to determine as it relates to; time to horizon, risk, probability, and market outlook.

All other factors being equal an option closer to the strike price will have a higher extrinsic value. Options with more time to expiration will also have a higher extrinsic value. Extrinsic value is an amount above the intrinsic value that a buyer is willing to pay for an option.

A more technical explanation for the high extrinsic value ATM is due to the relationship of Gamma, Delta and Theta (Option Greeks). For a short intro to option greeks follow the link.

Strike Price and Probability

Now that we understand; moneyless and option values we need to investigate how strike price has implications for profit and loss. Many beginner traders believe the closer to the strike price the higher the probability of profit, but this is incorrect. Profitability is a more complex system of cost, breakeven and risk.

A strike price at or near the current price will have the highest extrinsic value. A strike price further OTM will have a lower probability for expiring with intrinsic value, but will have a lower cost. A option deep ITM (Delta > .70) will have a higher probability of expiring with value but will be more expensive because of the combination of extrinsic and intrinsic value.

Assuming you wait until expiration to cash out of your position then you need to not only pass the strike price you need to beat the break even number:

- To make a profit as a call option buyer you must select a strike price that when combined with the premium cost is BELOW the stock price at expiration.

- Ex. 3 - Buy call option strike price $110 for $5.00 if the price at expiration is above $115.00 then the transaction is profitable.

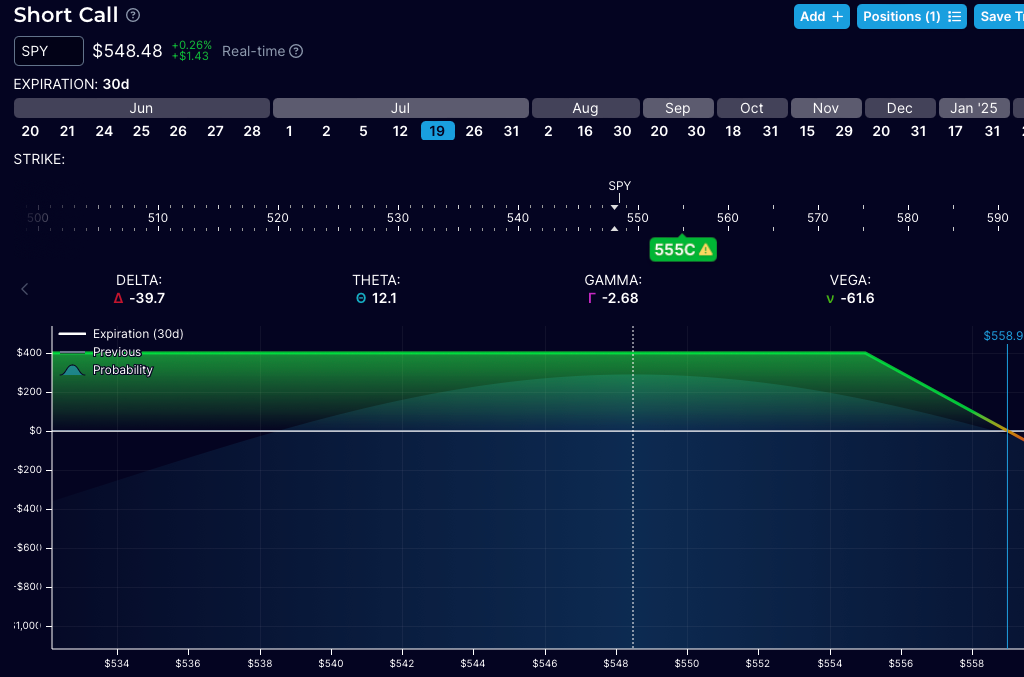

- To make a profit as a call option seller you must select a strike price that when combined with the premium received is ABOVE the stock price at expiration.

- Ex. 4 - Sell a call option with a strike price of $80.00 for $5.00; if the price of the stock is below $85.00 at expiration then this was a profitable trade.

An option at a strike price with an expiration will have a probability of expiring ITM. As a seller you would like to select a strike with a low probability of expiring ITM (generally, not always). As an option buyer you will generally want to buy an option with a high probability of expiring ITM.

Delta, a "greek" is a mathematical variable applied to an option that will loosely approximate the probability that an option will expire ITM. When selecting a strike price to buy or sell use delta as a guide along with the premium paid or received to weight the risk reward of the trade.

When selling a call option, a delta of .16 will have about a 16% probability of expiring ITM. Conversely Selling a call option with a .80 delta will have an 80% probability of expiring in the money. This information alone is not enough to determine profitability or even if they are a good idea.

An options vendor needs to weight the premium paid or received against the probability of profit. Strike price is one factor but expiration is another. A Stock may be trading at 100 and a strike price of 110 may be a great selection if the option is expiring tomorrow, but may also be a loser if the option expires in 6 months.

Evaluate the Risk and Reward Ahead of Time

It is important when choosing a strike price to understand what the potential outcomes could be. When Buying an option be prepared to lose the entire premium you paid, if the idea of a total lose of premium is too much to bear then it is best to avoid the trade. When selling options be prepared to follow through to take the maximum loss of the strategy. Never risk more than you are prepared to lose, as a rule of thumb I do not risk more than 2% of my portfolio in a single trade.

Options Vendors Pro Tips:

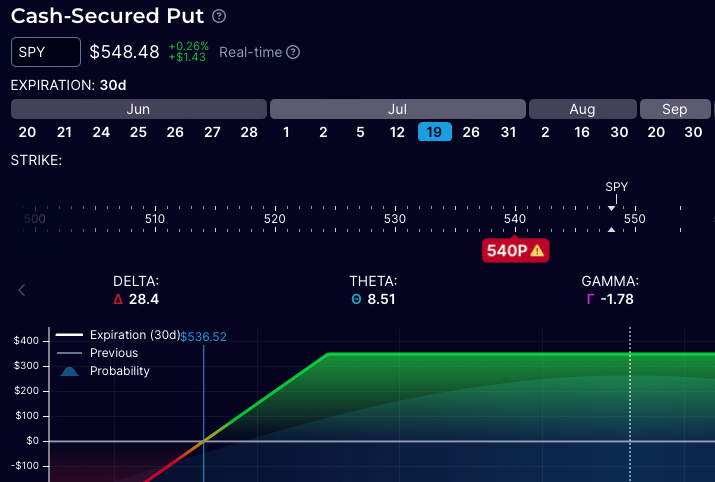

- Bias to selling options (especially far OTM): Selling options gets time on your side. As time passes all else being equal options lose value. However, selling exposes you to more risk so select carefully.

- Selling puts over Selling calls: Probably an over simplification but, selling a put on a great stock you would like to own anyway will just force you to buy at a great price. Selling calls is inherently bearish and the market has a tendency to go up over time.

- When choosing a strike price for buying an option, by options that are already ITM. This will reduce the chance that you lose your entire premium. ITM options are more expensive but less risky.

- When choosing a strike price for selling an option don't go so far out that the premium you receive doesn't justify the risk you take. An option sold with a 1% chance of loss could be a large nominal cost. Losing 1,000.00 to make 3.00 doesn't make sense over the long run.

Conclusion

The strike price is a foundational part of option trading. The strike price affects probability, profitability and risk. Knowing how to choose the correct strike for your overall strategy will determine if you can successfully trade options over the long term.

Outro

Be sure to subscribe to this site; we are going to take a totally fundamental approach to build this business, learn the profession, discover what to avoid, and what I wish I had known earlier in my career.